Overview

Over the last several years we have been developing and refining an artificial Intelligence (AI) model called Refyn©.

In the previous years we focused on AI Searching, AI content management systems (CMS), and Quality Scoring. This is all leveraged off of the AI server we built using two patents held by Search3w.

In 2024, we focused our R&D on what we call Bankii©, an AI framework to make financial compliance better by minimizing false positives in error definition.

Refyn, when mentioned in this application, is our API server. We have several client-sides that can call the Refyn API. The Search one is a production client software, and the Bankii client side is what we developed in 2024 through pure research and development.

It was our hypothesis that we could use our Refyn server to reduce false positives in the financial sector — when an innocent legal financial activity is flagged as suspicious, raises an alert, then undergoes a manual review to decide whether it is an actual red flag or a false positive.

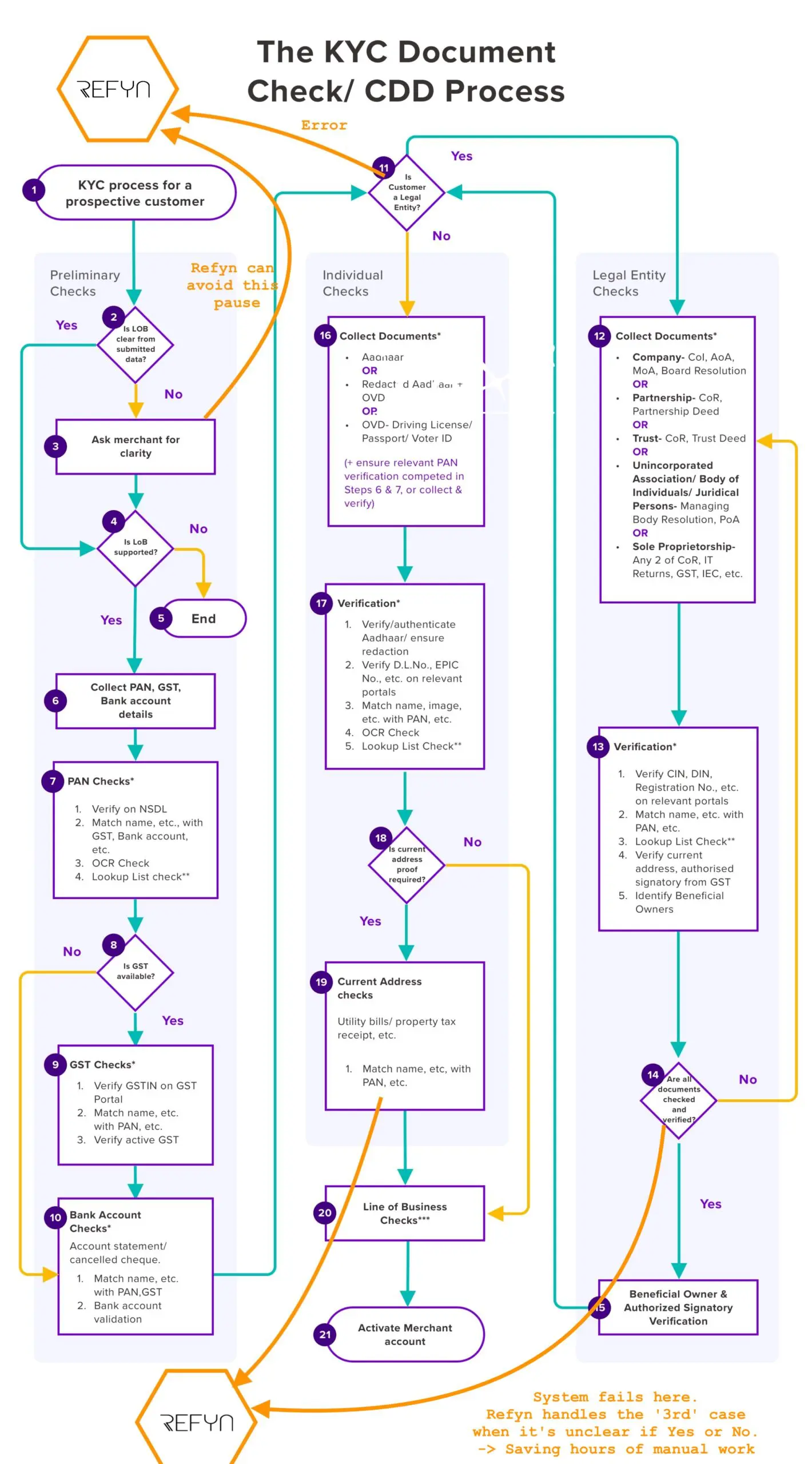

Because a mock client side has to be built to go through the research and experimental development, we began with just the know your customer (KYC) phase of financial protection.

The experimental development presented is defined in the steps required to build our system and in the aggregation of those steps to refine a system that reduces false positives in the AML and KYC sectors of finance.

Facing Scientific and Technological Challenges

Facing Scientific and Technological Challenges

Initial Experimentation

Bankii could work at the preliminary stage on KYC only, and not on AML with numbers or transactions. We had to conduct research on how to test this concept without developing a full client side. The client side is the addition to the AML/KYC layer and the backend is our existing Refyn backend.

In sequence, our experimental development began with the question: where do we get the data for our system? And once we have the data, what do we do differently with it to reduce the false errors in AML and KYC.

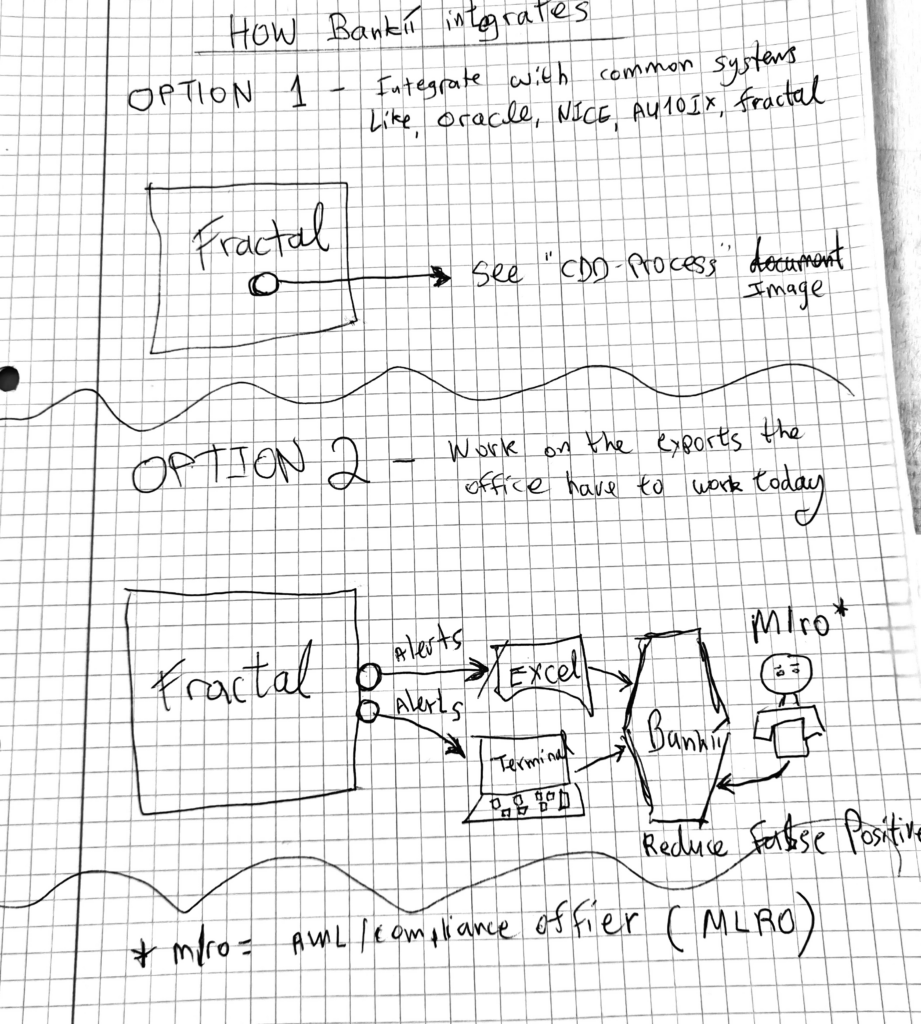

To the first question — where do we get the data for our system — we narrowed the possibilities down to two after exhaustive research and experimentation with various data intakes and data inputs for Bankii processing.

Data Sources

Integrate with Common Systems

We explored direct integration with widely used systems such as

- NICE™ Actimize

- Oracle™ Financial Crime and Compliance Management (FCCM) Solutions

- ComplyAdvantage™

- Ondato™ (KYC traveler’s check)

- AU10TIX™

- ComplyCube™

- Shufti Pro™

- Fractal™, and

- ThetaRay™.

This experimental development allowed us to determine how to create an integration API that would be open-ended enough to allow any financial services technology in the same marketplace to easily connect to and interact with Bankii as an easily integrated add-on. The work involved refining and reiterating the API as new conditions were met in various third-party data sources.

Work with Existing Exports

This option allows Bankii to work with data that is already being exported from existing systems. The experimental work here was the development of a workflow that could process the existing data. The flow we arrived at was receiving alerts, exporting to Microsoft Excel™, processing from Excel in a terminal or computer system, then sending to Bankii.

Bankii’s Cognitive AI system

Bankii’s approach to AI-driven security is distinct from conventional methods, we focussed on a cognitive, human-like analysis rather than relying heavily on historical patterns or extensive training data.

Feature-Based Analysis and Query Breakdown

The entirety of our system was designed and developed through an experimental process. Our advancements were iterations of the cognitive AI that amalgamated the previous versions, taking what worked and discarding what did not. Our system operates by breaking down the query into its basic features. We dissect complex information into fundamental attributes like shape, color, or feel, rather than processing the query as a whole, searching data sources by features. This granular, feature-centric search allows for a highly targeted and precise information retrieval process.

No large language model (LLM) training and no indexing are required. This is a significant departure from traditional machine learning models that demand vast amounts of labeled data for training and often rely on complex indexing for efficient retrieval. This creates a more dynamic, on-the-fly analytical capability.

We developed a process for visual data that can fetch images with shape, color, and certain items inside the image without scanning the pixels. Bankii builds upon an adaptive learning system that does not require training. Instead of being explicitly trained on datasets, Bankii is designed to just keep the unclear items aside and analyze them later sometimes within seconds to make them clear. Our adaptive, self-organizing learning process resolves ambiguities dynamically.

Refyn Analysis

Refyn is our backend used for analysis in Bankii. It enhances Customer Due Diligence (CDD), and its analysis is underpinned by a patent which generates persona — the characteristics of a person — which are then analyzed in detail. This is used by our sophisticated natural language processing (NLP) and entity extraction capability that builds comprehensive profiles.

The following attributes of our CDD were all developed through a reiterative design and development process characterized by experimentation, documentation of results, redirection and refinement through errors and successes at each step of the overall system.

- We designed fuzzy logic to find data matches with slight changes to names or addresses. This allows for robust matching even with minor discrepancies, which is crucial in real-world data where typos or variations are common.

- We developed focused keyword searches to dynamically monitor, screen, and filter transactions based on keywords from high-risk AML, counter-terrorism financing (CTF) and financial crimes typologies. This indicates real-time, context-aware monitoring based on evolving risk profiles.

- Our system has the ability to learn from an AI-identified suspicious activity to enhance transaction monitoring. This demonstrates a continuous improvement loop where the system refines its detection capabilities based on new insights.

- Our AI is designed to deeply analyze the entire content and in its full context, not just a piece of content at a time. This comprehensive approach allows for a more accurate understanding of complex situations, reducing the likelihood of misinterpretations that lead to false positives.

Scientific Technological Advancements

As a result of the work described, several scientific and technological advancements were achieved or attempted:

Cognitive AI with Minimal Training Data

A key advancement is the development of a cognitive AI system, Bankii, designed for human-like analysis without extensive training data or the need for large language model (LLM) training and indexing. This aligns with research into “bootstrapping AI cognition with almost zero data” 1 and unsupervised learning, where algorithms identify patterns in unlabeled data without explicit programming.3 The system’s adaptive, self-organizing learning process dynamically resolves ambiguities, reflecting advancements in AI that learn through self-play and feedback from minimal structured inputs.

Feature-Based and Granular Data Analysis

Bankii breaks down complex queries into basic features like shape, color, or feel, enabling a highly targeted search. This contrasts with traditional methods that often require massive datasets and complex indexing for holistic processing.1 This approach extends to visual data, allowing image retrieval based on features without pixel-level scanning.

Advanced Persona Generation and Entity Extraction

The Refyn backend enhances Customer Due Diligence (CDD) by generating comprehensive personas through sophisticated Natural Language Processing (NLP) and entity extraction capabilities. This leverages LLM capabilities for structured text generation and knowledge graphs for refining persona creation.

Robust Fuzzy Logic for Data Matching

The system employs fuzzy logic to accurately match data despite minor discrepancies in names or addresses, crucial for reducing false positives in real-world data. This includes techniques like Levenshtein distance and combinations with Damerau-Levenshtein and Metaphone for enhanced accuracy in AML/KYC screening.

Adaptive Transaction Monitoring and Holistic Contextual Analysis

Bankii dynamically monitors and filters transactions using focused keyword searches and learns from AI-identified suspicious activity, creating a continuous improvement loop. This adaptive learning refines detection capabilities. Furthermore, the AI analyzes content in its full context, rather than in isolated pieces, to achieve a more accurate understanding and reduce false positives.